London Quarterly Economic Survey Q2 2025

Wednesday 9 July 2025

Overview

The spending review in early June prioritised defence, the NHS and schools but left many departments short, although it also included considerable capital spending on several vital projects, spread across a number of regions, which must be good news.

What we found

- Business Costs: After a brief reprieve in Q1, the proportion of London businesses reporting a rise in business costs increased across all key areas in Q2.

- Labour Market: The share of companies that attempted to fill vacancies over the past quarter increased to 34%, up 9 percentage points from 25% in Q1 and returning above the 30% level seen in Q4 2024.

- Recruitment and Training:Recruitment difficulties remained essentially unchanged in Q2, with 59% of hiring decision-makers reporting challenges, virtually the same as in Q1 (62%) and the final two quarters of 2024 (61% in both Q3 and Q4).

- Cashflow and Investment: Cashflow conditions improved across the board in Q2, with fewer firms reporting deterioration and more seeing gains.

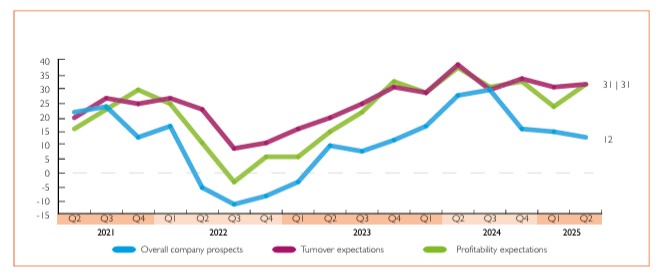

- Business Confidence: Profitability expectations have inched higher over the past quarter, with 49% of businesses now anticipating increased profits – up 3 percentage points from 46% in Q1.

- Economic Outlook: 36% of London businesses expect their own economic prospects to improve over the next 12 months – virtually unchanged from 37% in Q1 and 36% in Q4.

- Domestic Demand:The share of businesses reporting an improvement in cash flow rose by 7 percentage points, climbing from 24% in Q1 to 31% in Q2.

- Export Demand: In Q2, just 9% of all London businesses reported an increase in export orders – down from 12% in Q1.

About this report

The Q2 2025 results offer tentative evidence of recovery, but the uneven nature of this rebound raises pressing questions towards London’s long-term competitiveness. Larger and manufacturing businesses are driving progress across most metrics – from sales and cashflow to investment and hiring – while smaller firms, exporters, and outer London boroughs continue to face more limited gains.

This quarter’s fieldwork was conducted by Savanta between 17 April and 22 May 2025. A total of 506 London business leaders were surveyed, with data weighted to reflect the capital’s business population by size and sector.