Your learning module: Arab- British Certificates of Origin

Following on our July learning module, where we learned the background and general information about Certificates of Origin, it is now time to discover all there is to know about Arab-British Certificates of Origin, a document that every so often comes into play when trading with Arab League countries.

Let’s begin by refreshing our memory on Certificates of Origin before we dig into Arab-British Certificates of Origin (Arab Certificates for short).

What is a Certificate of Origin and why is it needed?

Certificates of Origin (COO) are trade documents used by exporters to confirm the origin of the exported goods in accordance with the non-preferential rules of origin; this means that they confirm the origin of the goods for countries where there is no Trade Agreement in place with the UK, or where the goods don’t comply with the preferential rules of origin established in the existing Trade Agreements between the UK and the importing country, in other words, it confirms the origin of goods not manufactured or produced in the UK. When shipping internationally, on occasion the country of origin needs to be known to the customs authorities in the importing country, could this be for Customs Clearance, Commercial, Economic, Political, or even environmental reasons.

What is then the difference between an Arab Certificate and a UK Certificate of Origin?

An Arab Certificate of Origin serves the same purpose of a UK Certificate of origin but is issued for goods that are being sold and permanently exported to Arab League countries*.

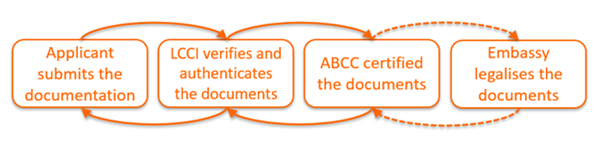

Depending on the country of destination of the goods, an Arab Certificate of Origin may need to be solely authenticated by the London Chamber of Commerce (LCCI) and then certified by the Arab-British Chamber of Commerce (ABCC), or it may also need to be legalised by the London attaché from the destination country. In essence, Arab Certificates share considerable similarities and serve the same purposes as UK Certificates, but their format and processing flow is slightly different.

*Algeria, Bahrain, Djibouti, Iraq, Jordan, Kuwait, Lebanon, Libya, Mauritania, Morocco, Oman, Palestine, Qatar, Saudi Arabia, Somalia, Sudan, Syria, Tunisia, United Arab Emirates and Yemen. Comoros and Egypt are also part of the Arab League, but both countries accept UK Certificates of Origin.

What is the relationship between LCCI and the ABCC?

From a trade documentation perspective, LCCI acts as an Agent on behalf of companies in need to apply for Arab Certificates. We verify their documentation prior to their submission for Certification to the ABCC and posterior legalisation by the corresponding Embassy (if needed).

How is an Arab Certificate of Origin processed?

In simple terms, the applicant submits the documentation, this is revised and authenticated by the officers at the issuing Chamber, then they are submitted to the ABCC for certification and if needed, they are submitted afterwards to the country’s Embassy to be legalised.

We strongly recommend submitting applications through our online portal for a fast-tracked service. This service is available for most Arab League countries, with the exception of Iraq, Lebanon, Libya, Qatar, and the UAE where hard copy documents need to be submitted directly at our Trade Documentation counter.

The Certificate will need to be completed digitally (not handwritten) and submitted to LCCI accompanied by all relevant documents, such as the Commercial Invoice, packing list and evidence of the claimed origin. More information about this further below.

As for the information this Certificate contains, both the UK and the Arab Certificate follow the same guidelines and are almost identical. One of the main differences between these Certificates is that declaring the name of the manufacturer(s) of the goods in the body of the Certificate is mandatory for Arab Certificates.This of course might not be ideal to exporters as it reveals to their buyers and counterparts information that should otherwise remain confidential; there are forms in which this step can be fulfilled whilst still maintaining this information confidential, as it is in the case of UK Certificates, should this be your case, please contact us for more information.

How do I apply for an Arab Certificate of Origin with LCCI?

First time applicants will need to register to use our online portal, for this, a Formal Undertaking will need to be completed. Once the account has been set up and the applicant granted access to the system, online applications will be ready to be created.

In the rare case that Arab Certificates of Origin are not listed in the document type menu, please email us to enable these Certificates in your account.

When creating an application, the below documentation must be attached, without it, our officers will be unable to verify the correctness of the information declared and the application will be have to be reverted to the applicant.

- Commercial Invoice

- Packing List - If packing details are not available on the Commercial Invoice already

- Proof of Origin – I.E. Copy of the Manufacturer’s Invoice, a Copy of the Foreign Certificate of Origin, Supplier’s Declaration or similar third-party evidence. This is only needed for goods not manufactured in the UK

Specific details on how to complete an Arab Certificate application can be found in our Arab Certificate application guide.

Some countries require the Arab Certificate and the Commercial Invoice to be certified/legalised as a set, in this case, the Invoice must hold an autograph signature from an authorised signatory (a signatory from the Formal Undertaking).

When submitting the application, it must be done so by selecting the “Chamber Printed Service” - Customer in-house printing is not available for Arab Certificates of Origin at this time.

Once the application is submitted, LCCI's Trade Documentation team will verify the documents and if all deemed correct, the application will be approved and payment in advance will be requested (via a payment link); without the payment, we are unable to submit documentation to the ABCC.

Should amendments or additional information be required in the application, our officers will revert the application back to the applicant, who will in turn be able to resubmit the application once the corrections have been processed according to the instructions provided by the issuing officer at the LCCI.

Equal to the requirements for processing Arab Certificates, the pricing also varies depending on the country of destination. To obtain a quote before applying for an Arab Certificate, please contact us and provide us with the country of destination, total value of goods and the process required, we need this information to calculate the cost.

For our certification process the turnaround time is 1-3 working days. However, where legalisation is required and given that there are more parties involved in this transaction, the turnaround time can increase to 7-10 days. Our commitment is to process documentation in a fast and effective manner and keep applicants informed of the process from beginning to end.

Once the documentation has returned to LCCI, we deliver the processed documents to the applicants following their delivery instructions. To this effect, documents can be collected from our premises, or we can post them via a traceable service.

Please note, Arab documentation submitted to LCCI cannot be collected from the Arab Chamber directly.

What are the specific Country requirements exporters should be aware of when applying for an Arab Certificate of Origin?

Each country has its own specific requirements and we unfortunately can’t list all of them here without overly complicating this module; we have nevertheless chosen a few “stand out” requirements to bring awareness of the type of requisites exporters can expect when applying for Arab Certificates:

- Kuwait, Qatar, and the UAE require Arab Certificates to be certified by the ABCC and legalised by their corresponding Embassies.

- Commercial documents to be legalised by the Libyan Embassy, need to be translated into Arabic prior to being submitted to the Embassy. Note the LCCI also offers Arab translation services.

- On an Arab Certificate of Origin to Libya, the Invoice value must be declared and mentioned in the body of the Certificate.

- Quotes for certificates for Algeria to be legalised are calculated against a daily exchange rate (provided to the LCCI by the ABCC), hence the quote initially provided can differ to the final cost provided upon presentation and processing of the documents.

- Algeria, Iraq, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, Sudan, Syria, Tunisia, the UAE, Yemen, and Palestine require the Certificate and its Commercial Invoice to be certified as a set.

- Kuwait, Qatar, and the UAE require the Certificate and the Invoice to be both certified and legalised.

More details about participating Countries within the Arab League and their individual requirements can be found on our website following this link and downloading the “Embassy Charges Matrix”.

Within our team, we hold the expertise to understand what is required for each country and are here to support with any questions regarding Arab Certificates of Origin. We strongly recommend applicants, especially those applying for Arab Certificates for the first time, to contact us and enquire about any specific requirements for the country of destination of their exports.

For more guidance and support, please visit the FAQ page.

Written by: Edward Jones, Certificate of Origin Account Executive, Jacqui Roche, Export Documents Assistant, Josh Viner, Export Documents Assistant, and Keith Bedford, Front Desk Assistant - Export Documentation.